Trying Again

In recent months, Samsung Electronics and Chinese supplier BOE have been at odds over advertising fees that have kept Samsung from purchasing LCD panels from BOE. Such fees are charged by Samsung to suppliers for including the panel manufacturer in Samsung’s advertising, with the idea that the cost of the advertising should be borne by all of those who benefit from it. This is a fairly standard practice in the industry and can influence where logos are placed, what type of advertising is featured, and a variety of other issues, all of which are part of volume and price negotiations. In May, when BOE and Samsung managements last met, they were unable to agree on such fees, which we believe BOE does not believe it should be paying.

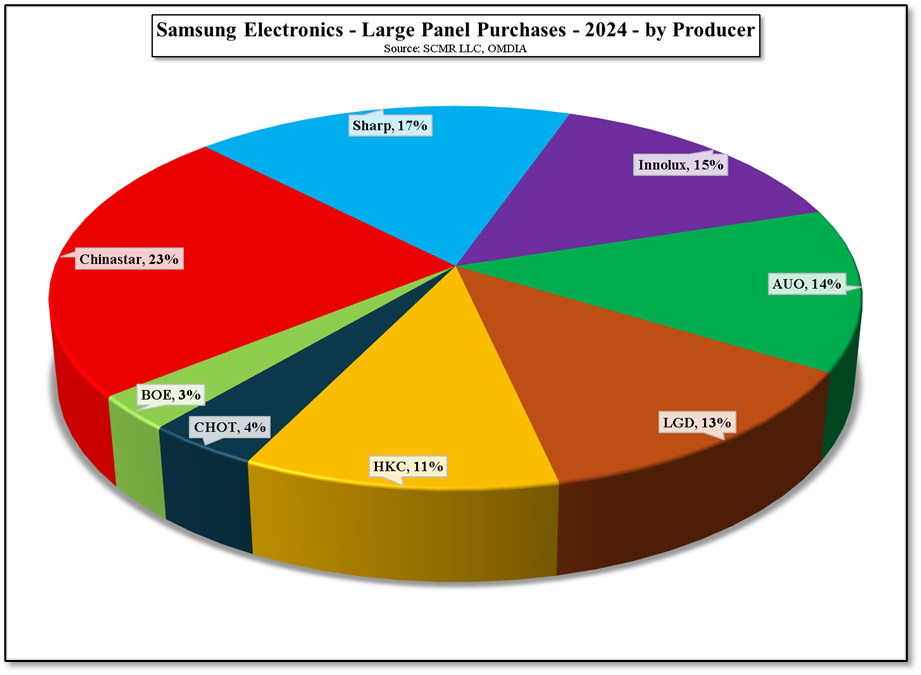

It seems that BOE is going to try again later this month and will be meeting with Samsung in Korea to try to develop a plan for supplying panels to Samsung once again. They hope to fill in a gap caused by a Samsung rule that keeps it from purchasing more than ~30% of its TV set panels from a single panel producer. This is a result of the fact that LG Display (LPL) sold its Guangzhou, China fab to Chinastar (pvt) at the end of March. As Samsung had already been purchasing LCD panels from Chinastar (~23%) and LG Display (13%) last year, when Chinastar took over the Guangzhou fab, it has the potential to push Chinastar’s total over 30% and Samsung needs to keep that total at 30% or less. We assume BOE is aware of that issue and is trying to use it to gain entry back into Samsung’s good graces.

BOE is expected to propose that it supply Samsung Electronics with 20m panels over the three-year period between 2026 and 2028. Additionally, in this round of negotiations, BOE is expected to agree to pay a portion of the advertising costs, but what BOE proposes and what Samsung is willing to pay for the displays is still going to take some negotiating on BOE’s part. Samsung does have the option of increasing purchases from its other suppliers. Whether the ongoing lawsuits enter into the discussions remains unclear, especially as those suits tend to be between Samsung Display and BOE, not Samsung Electronics, but BOE seems intent on regaining its place in Samsung’s supplier roster, from which it was missing in 2024. If nothing else, we give them credit for their determination.

RSS Feed

RSS Feed